The House of Representatives has granted approval for President Bola Tinubu’s request to obtain $2.35 billion in foreign loans to help bridge Nigeria’s 2025 budget deficit.

In addition, the lawmakers endorsed the issuance of a $500 million sovereign sukuk on the international market — an Islamic bond aimed at funding key infrastructure projects and diversifying Nigeria’s borrowing sources.

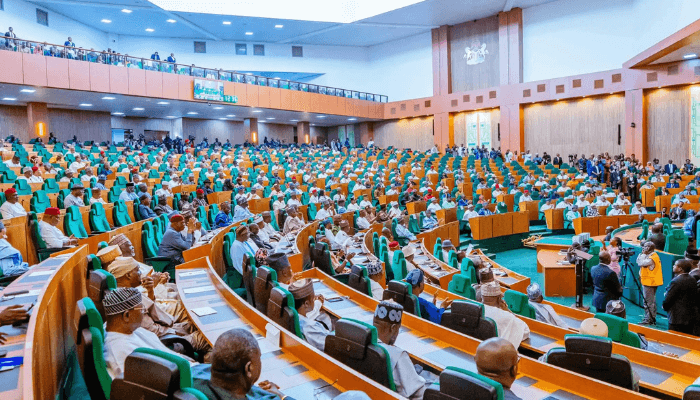

These approvals came after the House adopted the report of its Committee on Aids, Loans, and Debt Management during Wednesday’s plenary session.

According to the 2025 Appropriation Act, the approved borrowing includes ₦1.84 trillion (approximately $1.23 billion) in new external loans, based on an exchange rate of ₦1,500 per dollar, to help fund the projected ₦9.28 trillion fiscal deficit.

In his earlier communication to the National Assembly, President Tinubu cited Sections 21(1) and 27(1) of the Debt Management Office (DMO) Act, which require legislative approval for external borrowing.

He noted that the proposed loans may be raised through Eurobonds, syndicated loans, or bridge financing — depending on prevailing market conditions — and that interest rates would align with Nigeria’s existing international bonds, currently yielding between 6.8% and 9.3%.

Explaining the rationale for the $500 million international sukuk, Tinubu said it would attract new investors, deepen Nigeria’s capital market, and fund vital infrastructure projects. He added that since 2017, domestic sukuk issuances have raised over ₦1.39 trillion for road and capital development, and the new international issuance would complement those efforts.

Up to 25% of the sukuk proceeds may also be used to refinance existing high-interest debt.

With the House’s approval, the Federal Government can now proceed with the implementation of its 2025 external financing strategy.